Buying a bank auction property can be a smart way to invest in real estate at prices often lower than the market value. However, the process involves certain risks and complexities that require careful consideration. Understanding how bank auctions work, exploring financing options, and being aware of potential pitfalls are essential steps toward making a well-informed decision. For investors and homebuyers alike, keeping an eye on the latest bank auction listings can unlock valuable real estate opportunities. This guide will walk you through the process of purchasing a bank auction property, along with its key benefits and risks.

Table of Contents

What is a Bank Auction Property?

A bank auction property is a property seized by a bank due to the owner’s failure to repay a loan. These properties are sold through public auctions, and hence the name bank auction property. Banks aim to recover the outstanding loan amount, so they auction these properties at reduced rates. This makes such properties a popular choice for buyers and investors.

How to Buy a Bank Auction Property?

If you want to buy a bank auction property in India, it is crucial to understand the process:

Step 1: Locate Bank Auction Property Listings

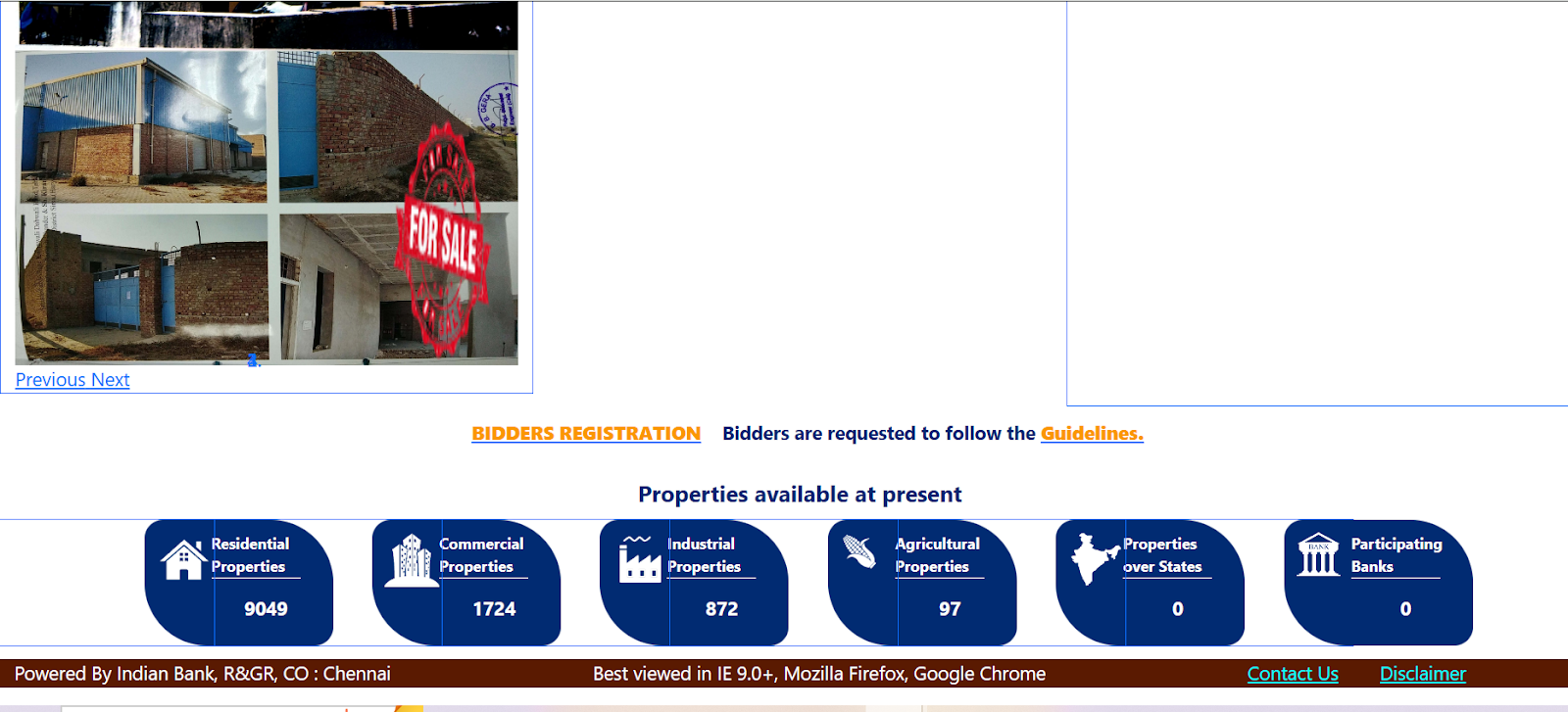

Visit the Indian Banks Auction Mortgaged Properties Information (IBAPI) portal to check the latest bank auction property listings. Here, you can find details of all the mortgaged properties available for sale via online auction by banks.

Step 2: Conduct thorough Inspections

Conduct a preliminary check after selecting a bank auction property. Verify any legal disputes, outstanding dues, or other property-related issues before participating in the auction. You are also advised to do a thorough physical inspection of the property on the dates mentioned in the e-auction notice.

Step 3: Submit a Tender Form and Deposit the EMD

The next step is to submit the tender form along with the Earnest Money Deposit (EMD). The EMD is usually deposited via demand draft or cheque. Make sure to cross-check the information you fill in on the tender form before submitting it within the deadline. Submit the required KYC documents to complete your paperwork for the bank auction.

Step 4: Participate in the Bidding Process

You can now proceed in the bidding process through various methods. The easiest way is through a bid form. However, if you wish to submit several bids, then make sure to submit different bid forms for each bid. Some banks require physical bid forms and a separate online bid form for the bidding process. In an e-auction, bidders can place multiple bids, as there is no fixed procedure.

Step 5: Review Auction Results on the Designated Date

Banks open all the qualified bids in front of the bidders on a designated date. You can check this auction result online, or by visiting the bank or the auction location on the auction result day. Winning bidders must deposit 25% of the bid amount within 24 hours. The remaining 75% must be paid within 15 to 30 days of the auction. The best way to arrange for finances to pay this deposit is through a home loan.

Step 6: Register the Sale Certificate at the Sub-Registrar’s Office

The buyer receives a sale certificate after paying the remaining 75%. The title transfer will be done once the sale certificate is registered at the sub-registrar office. Make sure to check that the authorized bank executive also signs the sale certificate during property registration.

Suggested read: Home Loans for Bank Employees

How to Participate in a Bank e-Auction?

Participating in a bank e-auction is a simple procedure.

Step 1: Visit the official website of the bank in whose e-auction you want to participate.

Step 2: Register as a bidder on the chosen bank property auction website.

Step 3: Once registered, accept the terms and conditions and follow the instructions to participate in bidding for a bank e-auction property.

Benefits of Investing in a Bank Auction Property

Here are the main reasons why people show interest in investing in a bank auction property:

- Lower Property Rates: These properties are available at lower prices as compared to the prevailing market rate. Hence, participating in a bank e-auction property helps to buy a property at a reduced price.

- Ready-To-Move-In Properties: Bank auction properties in India are typically ready-to-move-in. The buyer can move into the property as soon as the deal gets closed. This helps the buyer save both time and energy.

- No Legal Barriers: Banks inspect properties before putting them up for auction. This helps the buyer buy properties that come with no legal barriers or disputes.

- Easy Financing Options: On top of that, many banks offer easy financing options for auction properties. This is done to make it convenient for prospective buyers to secure funding.

Suggested read: Choose the Best Bank for a Home Loan

Risks of Investing in a Bank Auction Property

It is equally important to understand the risks associated with bank auction properties before you make the final call.

- Outstanding Dues and Liabilities: Before investing in a bank auction property, thoroughly check its history. The aim should be to check if there are any outstanding dues, liabilities, or taxes to be paid.

- Legal Verifications: Buyers must also conduct a title check to verify the ownership status of such properties. Banks are not the actual owners of the properties, they just seize them, so they may not take any responsibility for their condition.

- Limited or No Inspection Opportunity: Some auctions do not permit property visits or they only allow limited inspection time before the bidding. Hence, there is a big risk for such investments because there is no inspection opportunity.

- Pre-Bidding Deposits: There is also a prerequisite for buyers to deposit 10% to 15% of the total property value as a pre-bidding deposit. If the winning bidder fails to pay the remaining amount, the pre-bidding deposit will be forfeited.

Documents Required to Buy Bank Auction Property in India

Purchasing a bank auction property in India involves several legal and financial steps. To complete the process smoothly, you’ll need to gather the following documents:

- KYC Documents: PAN Card, Aadhaar Card, and Address Proof (passport, voter ID, utility bill, etc.)

- Auction Sale Notice / Bid Document: Issued by the bank detailing the property, auction terms, and reserve price. Acts as proof of auction participation.

- Earnest Money Deposit (EMD) Receipt: Proof of payment of the EMD, typically 10% of the reserve price, submitted before the auction.

- Bid Confirmation Letter: Issued by the bank to the winning bidder confirming the acceptance of their offer.

- Sale Certificate: A crucial legal document issued by the bank after full payment is made, transferring ownership of the property.

- Payment Receipts: Proof of full and final payment made to the bank for the property.

- No Objection Certificate (NOC): Especially important for properties in housing societies or under development authorities.

- Encumbrance Certificate: Shows that the property is free from any legal liabilities, loans, or disputes (obtainable from the sub-registrar’s office).

- Possession Letter: Provided by the bank once physical possession of the property is handed over.

- Sale Deed/Title Transfer Documents: After receiving the sale certificate, you may need to get the sale deed registered in your name.

Having these documents ready and verified helps ensure a secure and legally compliant purchase of a bank auction property.

How to Check Title & Legal Disputes on Auction Property

Before purchasing a bank auction property, it’s crucial to verify the ownership title and check for legal disputes to avoid future complications. Here’s a step-by-step guide to help you do this:

1. Examine the Sale Notice Carefully

- The bank’s auction notice usually includes basic property details.

- However, it does not guarantee a clear title, so further verification is needed.

2. Request the Sale Certificate Draft (if available)

- Ask the bank for a draft of the Sale Certificate.

- It contains details of the property, prior ownership, and the bank’s right to auction it.

3. Conduct a Title Search at the Sub-Registrar’s Office

- Visit the local sub-registrar’s office where the property is registered.

- Ask for the title deed history (past transactions) to verify the ownership chain.

- Check for any discrepancies or breaks in the chain of title.

4. Obtain the Encumbrance Certificate (EC)

- Apply for the Encumbrance Certificate from the sub-registrar’s office for a minimum of the past 13–30 years.

- The EC will show past owners, any mortgages, loans, or liens, and legal claims or court orders (if recorded).

5. Check for Pending Dues

- Confirm with the local municipality and utility departments for property tax dues and water, electricity, and maintenance charges.

- You may become liable for unpaid dues even if you weren’t the owner at the time.

6. Hire a Lawyer for Legal Due Diligence

A real estate lawyer can:

- Scrutinize all documents

- Check for civil or criminal litigation

- Search for court cases linked to the property in local courts

7. Review Society or RWA Records (if applicable)

- If the property is part of a residential society or apartment, check with the Residents’ Welfare Association (RWA) or society office.

- Ask for NOC and verify if there are any disputes or unpaid dues.

8. Online Court and Property Dispute Search (Optional)

- Some states and courts provide online case status tools (e.g., eCourts, High Court websites).

- Search by the property address or the owner’s name to identify any litigation.

What is Symbolic vs Physical Possession in Auction Property?

The e-auction of properties mortgaged to banks offers investors and homebuyers a unique opportunity to buy real estate at a competitive price. Although the process of buying bank auction properties may seem complex, thorough research, due diligence, and financial preparedness can help you secure a great deal. With the right approach, patience, and strategic bidding, you can turn a bank auction property into a valuable asset.

|

Aspect

|

Symbolic Possession

|

Physical Possession

|

|

Meaning

|

Possession taken on paper by the bank

|

Actual, vacant control of the property by the bank

|

|

Occupancy Status

|

Property may still be occupied by the borrower/tenant

|

The property is vacant and unoccupied

|

|

Legal Basis

|

Taken under the SARFAESI Act via public notice

|

Achieved through due process, possibly with police help

|

|

Buyer Access

|

Not immediate- requires legal action

|

Immediate – no legal hurdles

|

|

Risk Level

|

High potential for disputes or eviction issues

|

Low – ready for use or resale

|

|

Legal Effort Required

|

Yes – eviction or possession suit may be needed

|

Minimal or none

|

|

Recommendation

|

Proceed with caution; consult a legal expert

|

Preferred for hassle-free acquisition

|

How to Register Bank Auction Property After Winning the Bid

After successfully winning a bank auction, registering the property in your name is essential to gain legal ownership. Here’s how you can do it:

- Receive the Bid Confirmation Letter: Once your bid is accepted, the bank will issue a confirmation letter declaring you as the successful bidder. This document is important for the next steps.

- Make the Full Payment: You must pay the remaining amount of the winning bid (excluding the Earnest Money Deposit already paid) within the specified timeline, usually between 15 and 30 days from the auction date.

- Obtain the Sale Certificate: After full payment, the bank will issue a Sale Certificate, which serves as proof that the property has been sold to you. This certificate is signed by the bank’s authorized officer under the SARFAESI Act.

- Pay Stamp Duty and Registration Charges: Before registering the property, you must pay the applicable stamp duty and registration fees at the local sub-registrar office. These charges vary depending on the state and are calculated based on either the sale price or the government’s circle rate, whichever is higher.

- Register the Sale Certificate: Visit the Sub-Registrar’s Office with the Sale Certificate and supporting documents to get it officially registered in your name. Registration gives legal effect to the ownership transfer and is necessary for it to be recognized by law.

- Update Municipal Records (Mutation): After registration, apply for mutation of the property with the local municipal body. This step updates the ownership details in property tax records and ensures you can legally pay property taxes going forward.

Do You Have to Pay GST or TDS on Auction Property?

When purchasing a bank auction property in India, it’s important to understand the tax implications, particularly GST (Goods and Services Tax) and TDS (Tax Deducted at Source). Here’s a breakdown of when and how these taxes apply:

TDS (Tax Deducted at Source)

- Applicability: Yes, TDS applies if the property purchase price exceeds ₹50 lakhs.

- Rate: 1% of the total sale consideration must be deducted and deposited with the Income Tax Department.

- Who pays for it? The buyer is responsible for deducting and depositing TDS.

- Where to pay: File and deposit it via Form 26QB on the TIN NSDL website.

- Proof required: You’ll need to provide the TDS payment challan to the bank before they issue the Sale Certificate.

GST (Goods and Services Tax)

- Applicability: not always; if the auctioned property is a ready-to-move-in residential or commercial property, no GST is charged. In most cases, banks do not charge GST on auction sales as they are not considered builders or developers.

- When could GST be applicable?: If the property is under construction and is being sold by a developer or builder (not a bank), then GST at 5% (residential) or 12% (commercial) may apply. GST may also apply to auctioned industrial or commercial properties under certain conditions.

FAQs about Bank Auction Property in India

How to take possession of bank auction property?

To take possession of a bank auction property, you must:

Pay the full bid amount

Get the sale certificate

Register the property at the sub-registrar’s office

Can I get a home loan for a bank auction property?

Yes, you can get a home loan for a bank auction property. However, approval depends on legal clearance, eligibility criteria, and document verification.

How can I participate in the SBI property auction?

You can participate in the SBI property auction by registering on the SBI e-auction portal. Once registered, you must submit the KYC documents, pay the EMD, and then place the bid online on the auction date.

When can a bank take possession of the property?

If a borrower fails to repay the loan, then the bank can take possession of a property after issuing a 60-day demand notice under the SARFAESI Act, 2002.

What is the reserve price in an auction?

The reserve price in an auction is the minimum bid amount set by the bank or the seller. This price is based on property valuation and bids below this price are not valid.