BASIC TEAM

Last Updated on 5th May 2025

BASIC TEAM

Last Updated on 5th May 2025

Buying your dream home is a significant financial decision that must be taken with proper planning and consideration. While the journey is exciting, it comes with its share of challenges, which can affect your eligibility. However, with the help of a home loan eligibility calculator, you can analyze several key variables in advance to check your eligibility. Read the blog to learn about the home loan eligibility calculator, from its benefits to how to use it.

Table of Contents

A home loan eligibility calculator is a powerful online tool that allows you to determine housing loan eligibility in India based on various factors such as your credit score, interest rate, property type, loan duration, any existing EMI and down payment. It takes into account these variables and provides you with an approximate breakdown of what your monthly payments would be. By using a home loan amount eligibility calculator, you can quickly assess different scenarios and make informed decisions. You can also use monthly emi for home loan calculator to accurately calculate your per month installments for a home loan.

Suggested read: Home Loan Eligibility

A home loan is a loan obtained from a bank or a non-banking financial corporation (NBFC) to purchase a house. In the current economic climate, a home loan is one of the largest and most sought-after types of loans. Given that the value of real estate continues to rise, purchasing a home is a wise investment decision for both the owner and the investor.

If you plan to buy a home with the help of a home loan, then it’s a good idea to calculate your home loan EMI before signing the dotted line. You can also use monthly EMI for home loan calculator to accurately calculate your per-month installments for a home loan. The online home loan EMI eligibility calculator makes it simple to calculate your EMI.

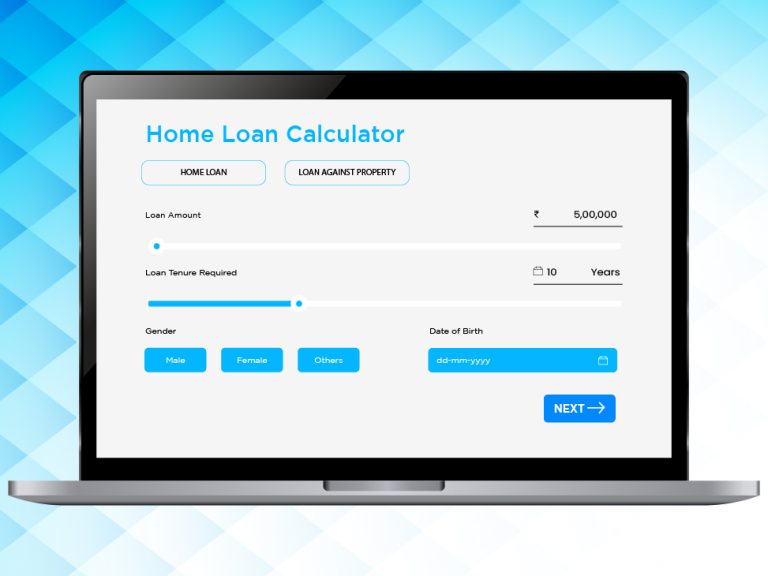

Start by researching online for a reputed home loan calculator website. Many financial advisory websites offer these tools for free. Choose a reliable one that provides accurate results.

Determine the amount you plan to borrow from a lender. This figure should reflect your budget and the down payment you can afford. Input this amount into the calculator.

The loan term refers to the number of years you plan to repay the mortgage. The common duration is 15, 20, or 30 years. Consider your financial goals and select a loan term that aligns with your plans. Put this term into the calculator.

Suggested read: Home Loan for Self-Employed Eligibility

The next step is to input your age and gender. Age plays a major factor in determining the loan amount as it helps in knowing the repayment years. Some websites may also ask about gender and city.

The lender would also like to know your source of income; whether you are a salaried or self-employed professional, and what is the mode of payment.

The next field to fill is your annual income after all PF, medical & tax deductions. In the case of a businessperson, the total take-home minus the expenses is considered as reliable income. If there is a co-applicant, mention his/her annual income too. Applying for a home loan with a co-applicant helps enhance your home loan eligibility.

Some websites also ask for your ongoing payments every month & the loan amount differs based on that. Consider your regular bills, such as utilities, groceries, and debt payments including car loans, student loans, and credit card balances.

Once you have entered all the necessary information, the calculator will give you an estimated loan amount offered by a number of reputed banks and housing finance companies. This figure will give you a clear picture of what you can afford. Take the time to review and analyze the results, considering different scenarios if needed.

If the estimated monthly payment is too high or you believe that you can pay more, consider adjusting the loan amount, loan term, or down payment to find a more manageable payment. Use the calculator to experiment with different scenarios until you find the most suitable option.

While a home loan calculator can provide valuable insights, it’s always a good idea to consult with a mortgage professional to discuss your options and ensure you have a complete understanding of the financial implications.

It is advantageous to use the home loan EMI calculator tool offered by BASIC Home Loan for a variety of reasons. The following are some examples:

Buying a home is a major financial commitment, and understanding your affordability is essential before making any decisions. A home loan calculator makes this easier by helping you assess your borrowing capacity based on key financial inputs. By analyzing these factors, you can make informed choices and select a mortgage plan that fits your budget and long-term goals. So, before you begin your homebuying journey, leverage the power of a home loan calculator to approach the process with clarity, confidence, and peace of mind.

The ideal rate of interest varies from bank to bank and mainly depends on factors like type of property, customer’s credit score and occupation. It usually starts from 8.50% and can go up to 15% per annum in ideal scenarios.

A co-applicant is any family member bound by marriage or blood including your spouse, father, son, unmarried daughter, and brother & sister (conditions apply). Distant relatives and friends cannot be co-applicant.

Longer the loan duration, more the interest amount you pay. So if you can repay quickly, you save upon the interest amount.

There are several government-run and private banks along with government-approved housing finance companies that offer best housing loans in India at reasonable rates. You can check their home loan eligibility with various banks to crack the best deal.